Working with us

Join our team

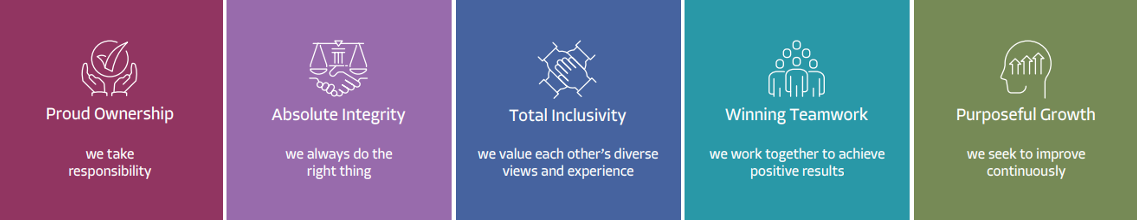

As a growing and ambitious company with an inclusive culture, we seek people to join our team who share our values. To deliver the exceptional levels of service we expect, our colleagues think of our clients, take ownership of their responsibilities and work together to deliver at pace. We call this ‘The Hampden Way’.

In return, we offer exciting career opportunities through professional and personal development, within a challenging and supportive environment. We also offer an excellent range of employee benefits.

Our values

Meet our people

Manahil Sheikh

Manahil is a Financial Analyst in our Finance team.

Georgina King

Georgina is a Business Manager working within our banking team based in London.

Crawford Philpot

Associate Banking Director Crawford works in our Edinburgh-based banking team.

Andrew Morgan

Andrew is a Solutions Designer in our Banking Operations team.

Current vacancies

About the role

As a Client Origination Analyst, you will ensure the timely and accurate processing of client data in the client and account creation process. To ensure that excellent client service is provided, and the expectations of Hampden & Co clients are met.

The main responsibilities of the role include:

- Ensure exceptional client service is maintained across the team, including but not exclusively:

- Client on-boarding

- Card ordering

- Cheque and Pay-in Book ordering

- Hampden Agencies Limited and Nomina plc relationship

- Ensure Service Level Agreements are met.

- Participate in project and change activities relevant to the team and the department.

- Provide support and temporary absence cover for colleagues.

- Any other related tasks which may be assigned from time to time which are reasonable in relation the role and skills and experience.

About you

As a Client Origination Analyst, you will have:

- Excellent organisational and time management skills.

- Ability to work accurately under pressure and meet deadlines.

- Strong attention to detail.

- A strong level of computer literacy and keyboard skills.

- Self-starter and team player.

- Desire to learn and enhance skills and knowledge.

- Experience and knowledge of banking processes or similar is desirable (but not essential).

- Experience in a similar role is desirable (but not essential).

About the role

Reporting to the FX & Liquidity Manager, the primary responsibility of the Assistant Treasury dealer is to action dealing activities within the delegated authority limits approved by the Board.

The Assistant Treasury Dealer is responsible in supporting Treasury Front office in the management and execution of all trades on behalf of the bank and the maintenance and development of Treasury systems.

The main responsibilities of the role include:

Key responsibilities of the role include but are not limited to the following:

Control

- Input deals into Flexcube (“FCUB”) together with supporting documents ready for FX & Liquidity Manager/ senior manager approval

- Update yield curves in ALMIS and static business rules in ALMIS in line with approach agreed at ALCo

- System test support, testing all systems for upgrades and for new Treasury products. Preparing sign-off sheet for manager/ senior manager approval

- Investigate potential issues and concerns regarding FX risk positions, working with the FX & Liquidity Manager making recommendations for improvement

- FCUB administration and the addition, amendment of data in FCUB and for example the addition of new counterparties and counterparty limits in FCUB

- Resolve data issues, working closely with Finance, ALM and other Bank departments

- Maintain and update Treasury Front office daily spreadsheet ready for FX & Liquidity Manager to use and in line with good practice and the Bank EUDA approach

- Work with ALM and Treasurer to develop the Bank’s spreadsheet/forecast for balance sheet management, recommending efficiencies and improvements

- Maintain and update files that are used to provide information for other departments

- Working closely within the team to ensure continual improvement reducing time spent on less value-add activities permitting more time to be spent on value-add activities.

- Update EoD daily FX and interest rate for FCUB working with IT to ensure completed in a timing manner in line with the Bank EoD timetable

- Work in collaboration with ALM, Banking Operations and Finance to ensure static data in core systems is accurately maintained (including FCUB and ALMIS)

Reporting

- Maintain and update across the day, Treasury daily Front office file including FX and intraday liquidity reporting.

- Preparation of Treasury month-end interest accruals.

- Develop knowledge of Treasury operations and other activities to be able with time to provide holiday cover and support increasing activities as the Bank continues to grow.

Operation

- Deputise for Treasury Front office Dealers and managers acting as contact for Treasury operations and Front office activities.

- Support the Treasury Front office managers in the execution of bank dealing activities including arranging foreign exchange contracts, placing fixed term deposits, arranging interest rate swaps, managing flows of funds from NatWest to Reserves Account, USD Liquidity Funds and purchasing securities for the Liquidity Buffer.

- Recommend improvement to Treasury operations, working with others to get approval for these changes and implementing in a timely manner.

People

- Develop close and collaborative working relationships with the broader CFO function and Banking Operations, working closely with Treasury colleagues, Finance, Banking Operations and Private Bankers to develop a strong and efficient operational business model delivering to the needs of all stakeholders

- Deputise for Treasury Dealer and Managers as required

- Identify technical and operational skills development courses which would further personal development

About you

As an Assistant Treasury Dealer, you will have:

- Attained a qualification at Degree / Higher / A-level in a financial or mathematical based subject. Desire for further personal development

- Ability to communicate effectively with various stakeholders

- Keen interest and desire to learn treasury financial instruments, fixed income securities, derivatives, foreign exchange and money markets and risk management concepts

- Good understanding of standard computer applications (Microsoft Office package) and competence

- Intermediate / Advanced Excel skills

- Keen for personal development and personal growth in line with a growing Bank

Job Role: Summer Internship

Location: Edinburgh or London

Contract Type: 6 – 8 weeks

Hours: Full time (Monday – Friday, 35 hours per week)

Salary Details: Competitive salary

Closing Date: 14th February 2025

About Hampden & Co

As a forward-thinking, socially responsible private bank, Hampden & Co provides bespoke banking to high-net-worth and affluent clients, their families, and associated businesses.

We recruit people to join our team who are motivated to work together to help our clients achieve their aspirations and who take ownership to deliver the exceptional experience our clients expect.

About the internship

We have an excellent opportunity at Hampden & Co for a summer internship. This internship would last for a 6–8-week period.

This opportunity is suited to you if you are motivated to work as part of a team, to take ownership of your responsibilities and to deliver at pace.

The ideal candidate for the role will:

- Excellent organisational and time management skills.

- Ability to work accurately under pressure and meet deadlines.

- Strong attention to detail.

- A strong level of computer literacy and keyboard skills.

- Self-starter and team player.

- Desire to learn and enhance skills and knowledge.

Main responsibilities / key duties:

- Ensure exceptional client service is maintained across the team.

- Support your team with day-to-day tasks.

- Participate in a project and change activities relevant to the team and the department.

- Any other related tasks which may be assigned.

How do I apply?

To apply for the role, please follow the link below to our website and then complete the application form, demonstrating your suitability for the role and how you think you share our passion for providing an exceptional level of service.

No agencies please.

On occasion, we receive significantly more applicants than expected for some vacancies and under such circumstances we reserve the right to bring forward the closing date of the advertisement. We therefore strongly advise you to apply for the role promptly, to avoid disappointment should the closing date be brought forward.

About the role

We have an excellent opportunity for a Financial Crime Analyst to join our 1st Line of Defence Financial Crime team in Edinburgh on a fixed term basis.

The role is Responsible for the Bank’s compliance with FCA regulations, supporting and maintaining effective Anti-Money Laundering (AML) periodic reviews and remediation programs within the organisation.

The Financial Crime Analyst monitors financial transactions, conducts investigations, and collaborates with various teams to ensure compliance with regulatory requirements. The role advises colleagues on AML / combating the financing of terrorism-related matters, and conducts enhanced due diligence on high-risk client relationships to identify potential legal, financial crime or reputational risk. This role is suited to you if you are motivated to work as part of a team, to take ownership of their responsibilities and to deliver at pace.

The ideal candidate for the role will have:

- Financial services experience, and knowledge of the financial crime compliance environment within the banking industry.

- A technical understanding of applicable AML and Sanctions regulations.

- Strong knowledge of AML regulations and compliance requirements inc. the Money Laundering Regulations and the EU Money Laundering Directives.

- Strong knowledge of money laundering typologies across a range of products and services in financial services.

- Experience dealing with sanctions, complex business models, PEPs, red flags and suspicious activity investigation.

- Excellent attention to detail.

- Strong analytical and interpretation skills.

- Strong organisational and time management skills.

- The ability to work accurately and independently under pressure to meet deadlines.

- The ability to communicate matters clearly and assertively, whilst in a collaborative manner.

- Strong influencing skills.

- The motivation to continuously improve self, within the team and across the business.

Main responsibilities / key duties:

- Perform AML risk assessments and provide recommendations for improvement, utilise AML software and tools to conduct real-time and periodic transaction monitoring.

- Provide advice and guidance on AML issues.

- Collaborate across teams to enhance AML processes and controls.

- Monitor and report on the firm’s compliance with AML standards.

- Stay updated on regulatory changes within the financial crime sector.

- Analyse financial transactions to identify suspicious activities and patterns.

- Conduct thorough investigations on flagged transactions and client accounts inc. preparing suspicious activity reports (SARs) to regulatory authorities when necessary.

- Conduct customer due diligence (CDD) and enhanced due diligence (EDD) process ensuring accurate record-keeping of client information and documentation.

- Work closely across the Bank to build and maintain effective relations in line with the Bank’s culture and values. Assist in creating and maintaining a strong financial crime risk aware culture at all levels.

About the role

The Project Manager will be part of the Hampden’s Change Management team and will deliver projects and change in line with Hampden & Co’s business plan and strategic objectives. The role will include planning and delivering complex projects and change in accordance with the Change Management Framework and in line with clear business objectives and scope

The role will provide the opportunity to work closely with all business functions to analyse, plan and deliver projects and change and will provide the opportunity to regularly work with stakeholders to ensure that delivery is achieved.

The role requires an individual who is comfortable working across multiple projects, of varying size and complexity. Operating within a small team, this role is suited to an individual with a can-do attitude who can take ownership of delivery tasks as well as project oversight and governance.

The Project Manager must be comfortable with project delivery through all phases of the change lifecycle and have the ability to make informed decisions, rapidly acquire new knowledge and skills and deal with staff at all levels of the organization (internal and 3rd party suppliers).

Great emphasis is placed on client service, both internal and external. This is integral to the role.

The main responsibilities of the role include:

- Manage the delivery of multiple concurrent projects of varying size to agreed timescales and quality.

- Prepare and take ownership of project plans, milestones, project resource demand and project reporting in alignment with organisational standards.

- Identify, track, manage and mitigate any project risks, assumptions, issues and dependencies, working with the 3 lines of defence.

- Analyse problem and opportunity statements and work with stakeholders to seek solutions.

- Facilitation of workshops, clear documentation of the outcomes ensuring the project scope has been clearly defined, this will require working with key business SMEs to ensure the business problem has been thought through and is well understood.

- Complete all project and governance documentation to the required standards.

- Ensure that services or products required for project delivery are delivered to schedule and are of high quality.

- Track and report on project costs and ensure the project is completed within allotted budgets.

- Track, report and realise project benefits and take the necessary actions required using a consistent approach.

- Build and maintain a positive working relationship with stakeholders across the organisation at all levels and including external partners.

- Work collaboratively with 3rd party suppliers tasked with delivering the joint implementation project outcomes.

- Challenge key stakeholders, third parties, vendors and business functions to deliver what is agreed.

- Chair Project Meetings to extract / share key information.

- Support the Test Lead, with the management and co-ordination of testing (incl. non-functional testing).

About you

As a Project Manager, you will have:

- An appropriate project management qualification and/or proven change management experience OR demonstrable experience in Business Analysis and managing workstreams and is looking to make the next step in their career.

- Flexible and adaptable attitude.

- Highly developed analytical skills and the ability to analyse and interpret complex information to identify and manage resolution of key issues.

- Experienced user of MS Office Products including a good working knowledge of Excel (data organisation, pivot tables, basic formulae).

- Excellent organisational and action planning skills.

Interested in working at Hampden & Co?

If you would like to know more about the roles available or about working at Hampden & Co, please contact our People Team.

Benefits

In addition to a competitive salary, we offer:

35 days annual leave, including public holidays

Salary exchange pension scheme

Discretionary variable pay award

Discretionary company share option

Group Life Assurance scheme

Private Medical Health Insurance

Health Cash Plan

Employee Assistance Programme

Enhanced maternity pay

Volunteering program

Give as you earn

Season ticket loan scheme

Cycle to Work scheme

Electric Car scheme

Annual flu vaccination

“Our reputation is built on the service we provide to our clients. We seek to recruit and develop people who share our passion for service excellence and who are committed to working together to help our clients achieve their aspirations.”

Career opportunities

To be kept up to date with career opportunities, follow us on LinkedIn.