Wealth and assets data underscores the value of high-end property

Property wealth in the UK has grown 51% over the past decade to a total of £5.5 trillion, at an average of £206,521 per person, according to the Office of National Statistics’ most recent Wealth & Assets Survey1.

However, while the value of property has increased by 51%, this has been outstripped by growth in overall wealth, up 59% over the past 10 years. As a result, property now accounts for 36% of Britons’ total wealth, down from 38% a decade ago. Overall wealth includes assets such as pensions and financial investments.

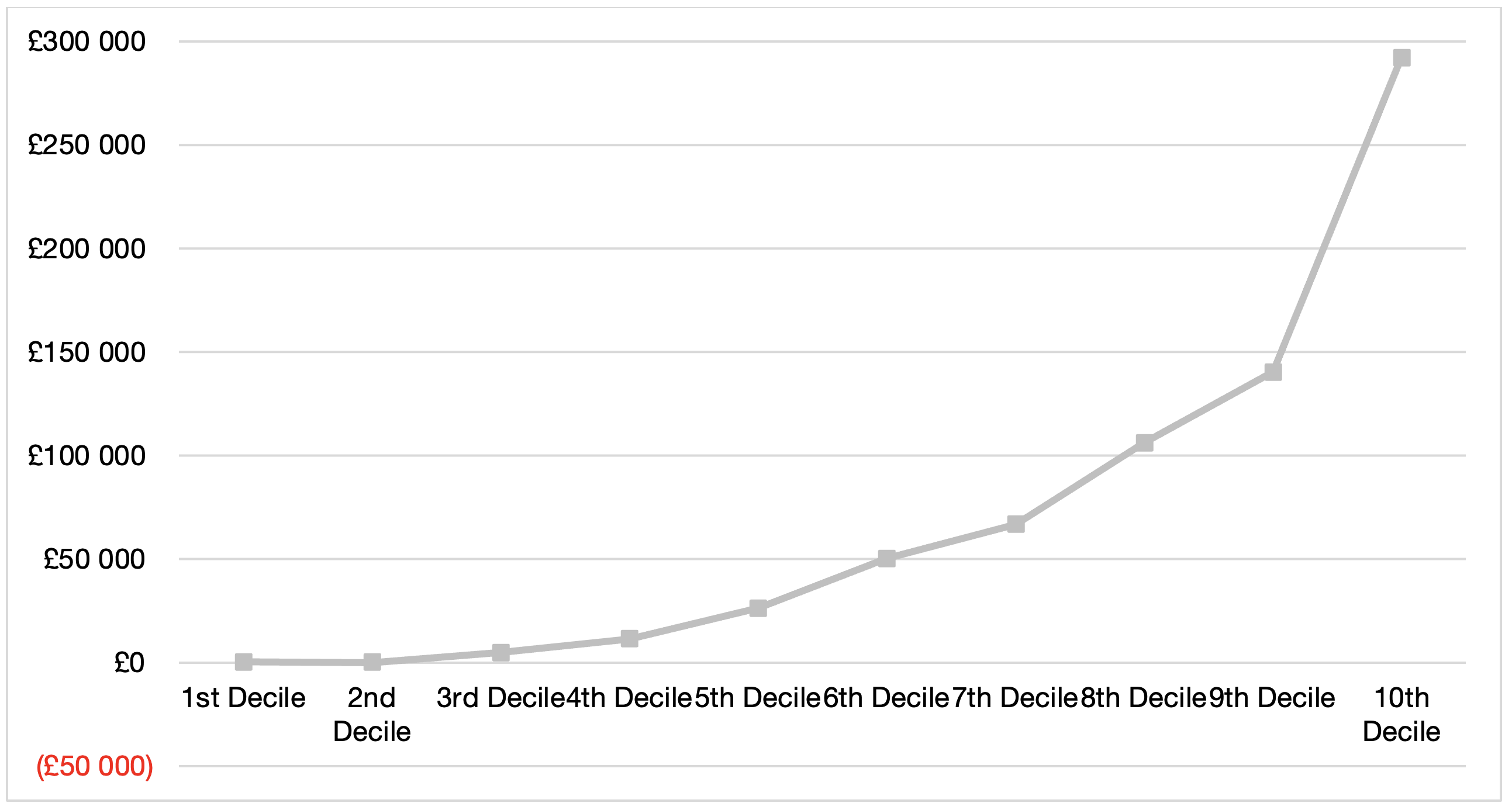

According to our analysis, the wealthiest 10% have seen their property wealth increase by almost £300,000 over the decade – more than double the increase experienced by people in the ninth decile (£140,289), and almost three times that of the eighth decile (£106,180). Average property wealth over the period rose by £69,887.

Across the 10-year period, the data shows those in the top decile in terms of wealth have seen their property wealth grow 59% to an average of £785,667. This represents annual growth of 5.9%, the highest among all segments.

The ONS’ Wealth & Assets Survey covers the period to March 2020, before the Covid-19 pandemic. It is the most comprehensive data source for UK assets and wealth, including the value of property.

In London, property represents a more significant proportion of total wealth, where it accounts for 49% of total wealth. This share has increased over the past decade (+4%) – one of only two regions, along with the South East (up 1%), that has seen a positive increase. All other regions have seen a decline.

Average property wealth increases, 2008-2010 vs 2018-20 by wealth decile

Source: ONS Wealth & Assets Survey 2020

Mark Prentice, Head of Banking at Hampden & Co said: “Property has been a fundamental aspect of wealth for many years and while our analysis shows its role in terms of total wealth has declined, the significant rise in property values is driving changes in behaviour. More people want to put the value in their property to work and this has been a key driver in the development of retirement and equity release mortgages. A greater number of our clients want to borrow against the value of their property as part of their inheritance tax planning and to pass their wealth on to the next generation.

And while the ONS data does not cover the Covid-19 era, we have also seen strong demand for lending over the past two years, including residential, guarantor, buy-to-let and self-build mortgages. Looking ahead, we expect property wealth will remain highly significant given the inherent, long-term value that it still provides.”